I have been thinking about an article I read on PYMNTS regarding Facebook and its Bay Area almnus eBay. There are a few things at play here which needs to be unpacked – who can acquire eBay, eBay’s decline and does Facebook make sense for eBay’s shareholders.

Pierre Omidyar started AuctionWeb that would become eBay and be a shareholder darling in the early 2000’s. eBay was an catalyst that put online auctions in front of millions of customers who looked for long tail items. Items such as Omidyar’s well documented broken PEZ holders (which turned out to be a myth), stamps, baseball cards and more was the items that drove eBay’s growth. The eBay alumni are found all over the ecommerce ecosystem in various senior roles and some have become investors into ecommerce.

Investors have been unhappy with eBay since John Donahoe took over from Meg Whitman but eBay as a commerce giant died the day they split from PayPal. Donahoe joined the PayPal board and Devin Wenig has been trying to grow a business that has lost its identity and key staff.

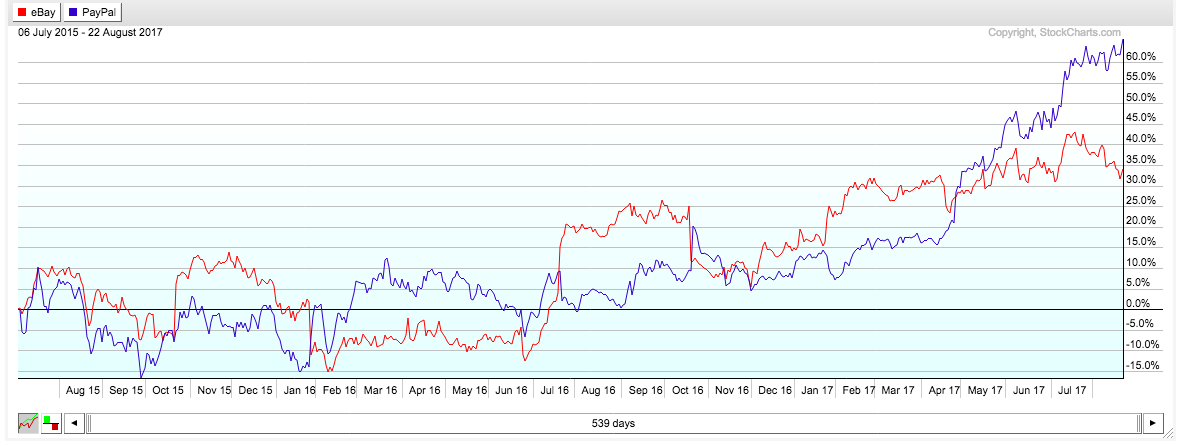

The eBay PayPal split in 2015

17 July 2015 is a day in which eBay’s lackluster growth came into view to investors. As much as eBay wont admit to it their board became a target for activist investor, Carl Icahn. Icahn pressed the eBay board to split their holdings. In hindsight what that did was to unlock the value in PayPal and start the downward movement of eBay. It is now clear that PayPal earnings carried eBay for an extended period of time. The eBay PayPal split unearthed the truth about eBay – it lost its identity, have now long term growth strategy and has become a springboard for executives to move to other businesses.

After EBay resisted Icahn’s calls for heavy restructuring, including a PayPal spinoff, Icahn launched a proxy fight to control the San Jose company’s board. In April, after much drama, Icahn and EBay reached a truce. Icahn dropped the proxy fight and agreed with eBay to add business leader David Dorman to the board — which later conducted the strategic review.

eBay vs PayPal stock price since June 2015

Doug Anmuth, a JPMorgan analyst:

“Some of eBay’s playbook sounds familiar, and management will now need to show that it can execute on it better than over the past few years,” said Anmuth in a research report. “But eBay also has some fallback with $1 billion to $2 billion in net cash at separation, more than $2 billion in annual free cash flow, and significant capacity to lever up and return capital if desired.”

“A stand-alone eBay also becomes more of an M&A candidate going forward, in our view,” he added.

eBay’s decline

eBay has been trying everything to stay relevant and honestly I think has a severe case of identity crisis. Before the PayPal spin off eBay did some great mobile commerce work yet once the changes were made it seems to have gone lost. I believe that the simple truth is that eBay has not moved with the change seen in ecommerce.

Marketplaces like Amazon, MercadoLibre, Zalando, Alibaba and Souq have become dominant due to providing customers with large selection, services that would get the purchase to them quickly. They show low customer churn in markets in which eBay operates.

As eBay has struggled with a clear identity they have been caught by being not sure what they are. Enterprise, Delivery services and cross border ecommerce have been tried but nothing has been given proper time to validate.

When eBay purchased GSI Commerce to form eBay Enterprise they also acquired Magento as they wanted to become a platform company.

Rubin sold his enterprise commerce business to eBay for $2.4 billion. GSI commerce as it was called then had some serious retailers as clients. eBay had a massive weakness in the enterprise space and fixed that by acquiring Magento and GSI Commerce.

Rubin pioneered an innovative pay-for-performance business model that fueled GSI’s organic sales growth, which he then complemented in recent years with 11 strategic acquisitions. GSI became one of the largest publicly-traded Internet companies, facilitating billions of dollars of merchandise sales for its customers, with 2010 revenues of $1.4 billion and more than 5,000 employees. As part of the transaction, eBay divested certain assets to Kynetic, specifically all of GSI’s online licensed sports merchandise business (Fanatics) and 70% ownership in Rue La La and ShopRunner.

Michael Rubin did the sales deal of a lifetime in which he gave his enterprise business to eBay for a large price yet he convinced eBay to sell him Fanatics, Rue La La and Shoprunner. Rue La La has continued to innovate and survived the impact of Flash Sales becoming an industry of capital expenditure and missed opportunities (Gilt Groupe). Shoprunner has become a competitor for Amazon Prime which is based in Chicago. Fanatics has over the last 18 months become a huge licensed merchandise ecommerce business that powers retail operations for sports leagues. Yet, eBay wanted nothing to do with these businesses..

eBay has since sold eBay enterprise and the company has been taken private with Magento being relaunched with an ex-Bay Enterprise leader leading it.

After months of negotiation, eBay has divested its enterprise e-commerce division in a transaction valued at $925 million. The new buyers—led by Sterling Partners and Permira Funds—are already breaking up the business.

What of the high-profile Magento software line, used by more than 240,000 companies worldwide? It will be spun into an independent company owned by Permira. Its new CEO is Mark Lavelle, formerly a senior vice president with eBay Enterprise.

eBay tried a personal home page feed for customers and a wide variety of activities to bolster their ecommerce efforts but honestly nothing has shown longevity. The simple truth for me is that the eBay marketplace has the wrong leadership and has been left behind while Walmart and Amazon grow their ecommerce reach. As much as Devin Wenig has said that eBay will not become like Amazon – as quarters move by they become more like a full price online retailer with branded boxes, product pages that show buy boxes.

Who can acquire eBay

I wont lie, this is the question I have been thinking about and it has become obvious with some help from Karen Webster from PYMNTS. In the US, Amazon and Walmart have no need to purchase an asset that has shown consist decline in quarterly reporting. The Chinese behemoths, JD.com and Alibaba have no interest in acquiring a US asset as that would lead to political intervention and a battle with a dominant local marketplace. Also the Chinese marketplaces have shown the place where they are investing – South East Asia.

The commerce businesses mentioned are all ensuring that they dominate their markets and thus it would be a technology company that needs a revenue generation channel that would align with their business. Google has not shown the appetite to invest in ecommerce and thus I take them out of consideration. Thus the most logical business would be Facebook.

Facebook – the commerce entrant

Let me be clear eBay fits Facebook well. eBay I believe are looking to become a subsidiary of another large business to ensure that they dont meet the fate of Yahoo!. eBay has assets that would provide signifiant upside to Facebook. The reality is that Facebook has struggled to master commerce as they are not inherently a commerce business by design. We have seen that they have long term ambitions to enter commerce and that a data set that would rival that of Google as Facebook users like pages and products daily on their various platforms.

Classifieds

eBay has secondary market services like Stubhub, Gumtree and other dominant classifieds operations that would legitimize the Facebook marketplace instantly. All of these classifieds services struggle with 2 things – fraud and purchasing signal. I can see the usage of Facebook profiles to deter the possibility of fraud from these classified marketplaces. Secondly, the purchasing signal can be seen from brands and products that Facebook users have interacted with.

The marketplace business that eBay currently operates is not a long term sustainable business in the US. In India eBay has sold their business to a local startup that provides them with a seat at the table to battle Amazon. A eBay and Facebook tie up makes sense to me and thus ensures that the eBay brand does not die in a way like what Yahoo! did.