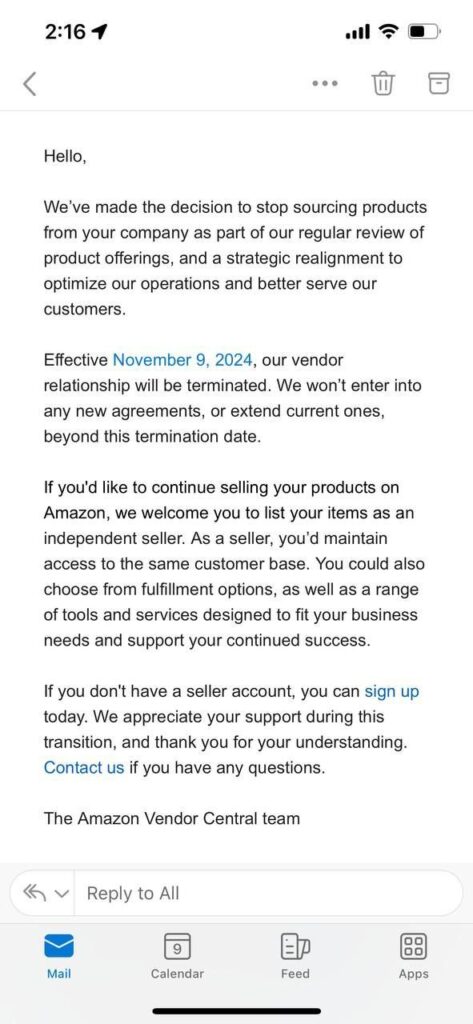

The more things change, the more they stay the same. My LinkedIn feed contained posts about Amazon mass terminating vendor (1P) agreements. These businesses have been given sixty days to move their businesses to sell via Amazon’s third-party seller platform. Why are these terminations news, and what impact will the terminations have? While I am sympathetic to these brands that have been bad news in Q4 before Prime Big Deals Day and the festive season, it could have been much worse.

The viral screenshot of the Amazon Vendor Central email sent to select vendors.

Amazon vendors must be reminded that selling via 1P is seemingly a privilege, not a right. Amazon uses supply and demand and exclusivity better than any e-commerce platform. The business model has been replicated by venture capital and private equity with little or lower margin. The business model only works for Amazon due to contribution profit. Using different parts of the Amazon business, such as advertising and logistics, combined with volume, will generate margins that make sense.