This is the first in a series of posts regarding Amazon’s competitors.

Game on between Cupertino and Seattle:

It is clear to me that Apple is the company at the moment that can topple Amazon. It won’t be overnight but rather the process will take some time and will need Amazon to drop the ball (which at the moment I am not seeing any time soon).

Apple in it’s current form can take Amazon head on. When Steve Jobs and Steve Wozniak founded the company, the main purpose was to create personal computers. The rest is history and is outside the bounds of this post. The point is Apple has software and hardware creation in it’s DNA.

Apple has a much larger global footprint in comparison to that of Amazon and in my mind it makes more revenue based on providing opportunity to users to spend money on its App Store and iTunes. One thing that must not be forgotten is that Apple has 400 million credit cards saved by users on their iTunes platform. It may not be one click buying but the process is user friendly.

In terms of content, Apple can match and exceed the amount of content that Amazon has. The content I refer to is ebooks, music and apps which all lead to income for the Cupertino company. Steve Jobs was the only competitive CEO that realized that eBooks was a genius move by Bezos. However he took the potential negative of not being first to market and turned it to a positive by actively trying to assist publishers in fighting versus Amazon. In the end it lead to legal proceedings and a hefty fine for Apple (which they are contesting) but Apple will continue in the content game. Not one direct competitor took the Amazon bull by the horns as Apple did.

The game breakers that can hurt

There are 3 assets that I believe should keep Bezos up at night. I believe that he has no other way of responding to these challenges but to lead Amazon towards them.

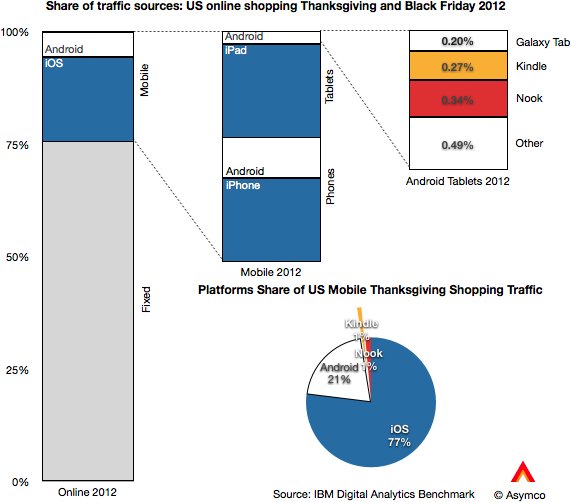

1. Devices – Apple has put itself in a position of incredible strength. The iPhone and iPad have become the drivers of commerce and conversions. If you are in the position to be aware of what your users are buying and on what they browse then it is a clear an advertising play is either in the works or acquisitions are to be done to maximise it. As much as Kindle is part of the Amazon play book, it has catching up to do to the iPad and iPhone. The Kindle Fire is a great device but it is nothing but a portal to Amazon’s digital kingdom. Rival that to the iPhone and iPad then you realise that Amazon is playing catch up. The iPhone is without any doubt, the biggest asset in Apple’s vault and in my mind it is a matter of time before a Kindle phone is to come to market. Apple provides a device that becomes an integral part of users lives and it becomes a habit.

Source: Asymco

2. Platforms – Apple is a software company. It has taken something called OS X and cannibalised it to create iOS. iOS is managed like an asset, in order to be able to play in the Apple Garden, you play by Apple’s rules. iOS did not exist prior to the iPhone but has steadily become the driver of customers to apps, browser and shopping carts. Apple owns all of the intellectual property to all software provided to its users ( yes, some contains patents by other companies). Compare that to the Kindle Fire which has a forked version of Google’s mobile operating systems under the hood and then you realise that Amazon is at the mercy of a competitor, which most cases lead to legal proceedings. What Amazon needs to do is either negotiate a license structure with Google as the Mountainview company can pull the plug on that forked version at anytime. Apple have no such concerns as they control the entire software ecosystem found on their devices.

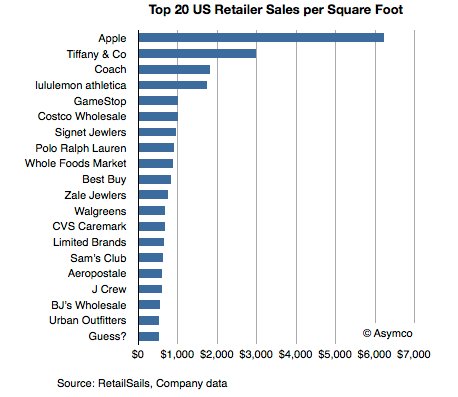

3. Retail – Physical stores are a huge part of Apple ‘s earning potential. It is scaling it and rapidly opening in more geographical locations. In my mind they are the only western company that can crack China, which would lead to a very solid balance sheet. The money is going to be Apple and it’s subsidiaries and not being spent online on Amazon. One thing to keep in mind is that Apple Stores have seventeen times better performance than the average retailer.

Apple is in such a favorable position that it can take their online store down for minutes to load the newly unveiled products and make them available to their online customers. No other online shop has that kind of loyalty bar Amazon.

Talking of online shopping, did anyone notice the refurbished store on eBay that has official Apple backing.. Why did they go to eBay and not Amazon Marketplace? You keep your direct competitors in the dark and go to a struggling competitor to help them..

Culture of the businesses

One thing that does need to be mentioned is that Amazon and Apple also share something else. Both businesses have very loyal staff and their top management teams contain staff that have been working with the business for many years.

Not all is perfect in Cupertino

However, Apple has a few issues that they need to resolve:

1. They have little or no cloud strategy. ICloud got press coverage when it was unveiled but seemingly has become nothing more. Did they spend millions of dollars on a North Carolina facility to just host user data?

2. Their supply chain has bottlenecks. When a new device is launched demand ensures lead time for consumers. Amazon has a similar issue but they have investigated heavily in robots and more distribution facilities, withe the exception of investment into Foxconn and Sharp (which is unconfirmed) I don’t see Apple doing anything to resolve this.

Does Apple invest more into their online commerce business to take on Amazon? I doubt they will but I believe they will keep Amazon and Bezos honest. They will continue to disrupt businesses and industries (Passbook has huge potential if properly managed) but keep out of going after a specific competitor. They also have to be mindful of their own competitors.