Amazon has had Chinese cross-border marketplaces such as Shein and Temu in their periphery more than what they will admit to. Chief Executive Officer Andy Jassy indirectly mentioned the companies when he referred to “cost to serve” in his annual shareholder letter. Amazon adding a dedicated discount store on its marketplace for Chinese goods that are cheaper and shipped at slower speeds enable them to play both offence and defence to competitors.

A decade ago, no marketplace would think about launching in the US, Germany, UK and emerging markets such as Brazil as in all cases a market leader exists. The four Chinese Dragons – Shein, Temu, TikTok Shop, and AliExpress are all connecting customers to Chinese manufacturers who have factories that are idle and are in need of orders to drive revenues and be able to pay salaries to staff. Cross-border e-commerce has evolved from being a niche to a direct competitor to marketplaces in global markets in offering customers access to cheap goods made in China shipped in days instead of hours to consumers.

These Cross-border Marketplace Launched At The Right Time

These cross-border marketplaces have entered markets in a time when consumers are facing higher prices, shrinkage of CPG product sizing in stores and inflation which has led to value buying in store and online. As much as we hear that the consumer is resillient, being able to purchase things you need or want for a fraction of the price has driven the downloads and usage of these apps. The fact that they have leveraged de minimis that have been increased to boost global trade or help customs officials handle larger volumes of goods is the fault of lax regulation.

These companies have realized that they can send heavily (read billions) on digital advertising on Google and Meta platforms to drive users to their apps that contain elements which drives adoption and purchases through gamification and marketing not seen in the West.

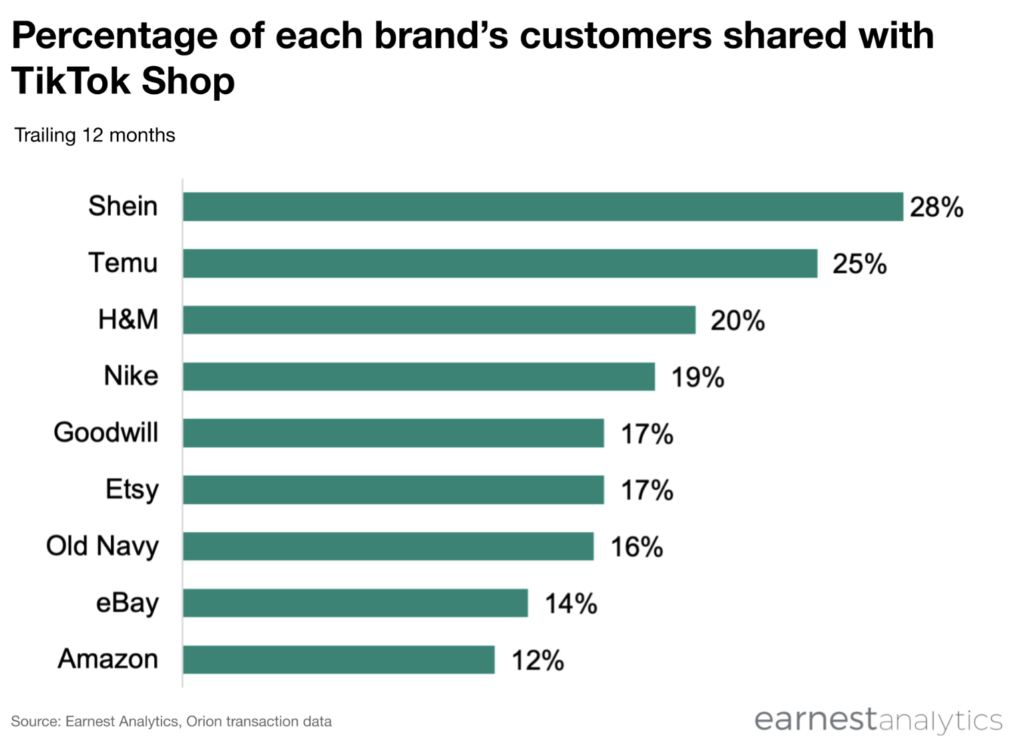

It is also worth noting that TikTok Shop is only active in the UK, US, and Indonesia. Where Shein, Temu and AliExpress are available to many more markets. These companies are also competing with themselves as they overlap in user bases.

Why did Amazon launch this now?

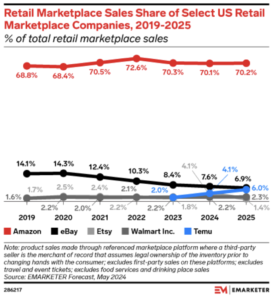

Amazon does not want any other platform to potentially disrupt the relationship it has with its customers. The misconception is that these platform mainly target lower to middle tier customers but these platforms also see sales from high-earners. That is the first potential threat that Amazon has as these consumers could overlap with its most valuable set of customers – Prime members.

By adding this discount section on Amazon. Amazon offers its customers access to unbranded fashion items, household goods, and other products that will ship directly from China over a period of 9 to 11 days. As these items will below the de minimis values of $800 these items will not be eligible for customs and excise tax costs which nullifies the benefit Shein, Temu, AliExpress, and TikTok Shop has had.

It also provides Amazon another program to offer to Chinese manufacturers who have utilized fulfillment by Amazon (FBA) thus far which has made it less appealing to Chinese sellers who are interested in cross-border programs. It also provides Chinese manufacturers another opportunity to de-risk themselves from the managed programs offered by Temu and Shein. Currently sellers on Temu, Shein are on a tight leash and are penalized when returns occur for the items sold on the cross-border apps.

What we are are currently witnessing is the battle for Chinese sellers between the various marketplaces that service large audiences. Amazon, Walmart, and eBay have long had Chinese sellers on their platforms but that was using traditional supply chain and business models. Temu, Shein, AliExpress, and TikTok Shop are likely all to invest in warehousing and supply chain in the US to place inventory closer to customers. Being able to drive demand via a consignment model which the Chinese cross-border marketplaces has been a relatively new business model also call customer-to-manufacturer made popular by Pinduoduo. Amazon is now offering this to Chinese sellers which likely will see adoption in the next six months. What stops Amazon from offering this to other markets that have free-trade agreements with a specific market? Now that is an interesting question.

Amazon most likely will utilize advertising to draw consumers and traffic to these products on its app and on its marketplace in a manner that the Chinese cross-border marketplaces can’t. What this likely could lead to is these marketplaces purchasing advertising from Amazon to drive traffic to their apps which will lead to additional costs for these platforms.

Amazon also retools its supply chain to negate the raising number of startups such as Portless, Redefined Logistics and others who are offering direct fulfilment from China through the use of air cargo. Amazon wants to be the supply chain that powers all forms of commerce and it makes sense for them to offer this program to Chinese sellers in the near term. What about direct-to-customer companies who want their goods to be shipped from China – would Amazon not be able to offer this at better pricing that any other company?

Unintended consequences

This discount focused shipped from China sector on Amazon will definitely cause brands to be concerned about whether their listings will be showed alongside these products on Amazon. Amazon will have to ensure that these products cannot be seen alongside branded products such as those from direct-to-customer brands that are already cautious about listing on the platform.

How will Amazon ensure that no-counterfeits or products that have intelllectual property associated with them be found in this new store on Amazon? Amazon has done a decent job of cleaning up counterfeit products but browsing Shein, TikTok Shop or Temu will quickly showcase branded goods that should not be for sale to consumers. I just recently saw Crocs, On running shoes while browsing AliExpress and Temu. So guard rails will be critical to maintain the trust of global brands that have manufacturing in China as part of their business model (its many brands).

In Conclusion

Amazon will defend its marketplace business from any competitor whether its a local marketplace or a cross-border marketplace. They will protect their most valuable set of customers – Prime members.

E-commerce executives, you should have ensured that before having your products made in China that those manufacturers cannot sell your products without your permission. Whether its excess stock or stock with defects – they should not be for sale on any marketplace globally. Your intellectual property should be registered in China before production is started otherwise your brand has no recourse.

Agencies, if your brand partners are found in fashion, household, and other categories you will need to ensure that software that tracks marketplaces for counterfeits or look-alikes/dupes must now have Amazon in it. You will need to ensure that your vendor manager or contact point at Amazon is clearly aware that you are holding them accountable for unapproved products being sold via Chinese sellers if it happens.

Private equity investors now will have to add another due-diligence step in potential acquisitions. If the brand has its products manufactured in China – is its IP protected in China and in other global markets. Secondly, are product designed trademarked or registered by the local patent office to ensure that no dupes can be made or sold in other markets. Do your brands have water tight legal contracts with distributors in all of its markets to ensure that your products are not for sale on any markets without your approval?