When I started in e-commerce the algorithm was akin to a secret. It was immovable nor helpful but eas needed to be respected as it could hurt businesses.

Over the last 18 months, it has become clear that we are at the beginning of the end for the algorithm. Regulators are no longer satisfied with companies negatively impacting businesses, sellers, or customers. Self-regulation failed as platforms could grow revenues through the use of an algorithm without oversight, nor were there any consequences for anomalies that benefited one side of the platform partnerships.

Increasingly, European regulators are asking platforms and marketplaces for data and explanations of recommendation services or their algorithms that determine search results. What data is being used to calculate the location of listings (never mind relevance or accuracy), or how are recommendations being developed to drive additional consumer purchases? As artificial intelligence gains momentum and usage by platforms to drive personalization across various parts of the web, e-commerce, as we know, is likely ending. Bias, inaccuracy, and irrelevance can negatively impact platforms, consumers, and brands. Regulators want transparency to offer a level environment as competition intensifies in all e-commerce markets.

Where did the Algorithm Investigation begin

In 2022, The UK’s Competition and Markets Authority (CMA) started an investigation into how Amazon decides the listing of the buy box. The buy box algorthim is arguably the most valuable and sought after algorithm in e-commerce. The theory was that Amazon would boost the listing of its own retail business (1P) or third-parties that utilizes its fulfillment services (Fulfillment by Amazon). In November 2023, the CMA announced its findings in which Amazon is required:

“Guarantee all product offers are treated equally when Amazon decides which will be featured in the ‘Buy Box’. This relates to concerns that products being offered by third-party sellers were less likely to appear in the Buy Box than similar offers from either Amazon’s own retail business or third-party sellers that use Amazon’s delivery services.”1

In February 2024, Mexican regulator COFECE investigated Amazon and Mercado Libre for anti-competitive behavior related to sellers. These two marketplace combined own 85% of the Mexican e-commerce market.

“COFECE also orders Amazon and Mercado Libre to take all necessary and sufficient actions to ensure that sellers can find comprehensive information about the variables and weighting factors they consider in selecting the featured offer,” according to a Mexico Business News report on the COFECE findings and corrective measures.2

South Korean regulators have asked Chinese marketplaces and local marketplaces for business information. South Korean e-commerce has been deeply impacted by Chinese cross-border marketplaces such as Shein, Temu, and AliExpress and have sanctioned marketplaces for deceit [PDF].

“The Fair Trade Commission (FTC) said it launched in-depth research on the online retail market following a monthslong preliminary study and will ask 40 major platforms to submit data on their business structure, logistics system and profit models, among other things, reports Yonhap news agency.” 3

On Friday, the European Commission sent Amazon a request for information related to recommender systems and ad transparency.

“In particular, Amazon is asked to provide detailed information on its compliance with the provisions concerning transparency of the recommender systems, the input factors, features, signals, information and metadata applied for such systems and options offered to users to opt out of being profiled for the recommender systems. The company also has to provide more information on the design, development, deployment, testing and maintenance of the online interface of Amazon Store’s Ad Library and supporting documents regarding its risk assessment report.”4

American regulators have sadly shown a slow response to e-commerce regulation and have been impacted by lobbying. However, what is happening is that States such as California are taking guidance from European regulators and creating laws to regulate marketplaces and e-commerce.

The EU’s Digital Services Act mandates platforms and services to adhere to governance standards, including content moderation, and to address risks related to illegal goods sales. Larger marketplaces, like Amazon5, have additional algorithmic transparency and accountability obligations, which are emphasized by Commission RFIs.

So Why Now?

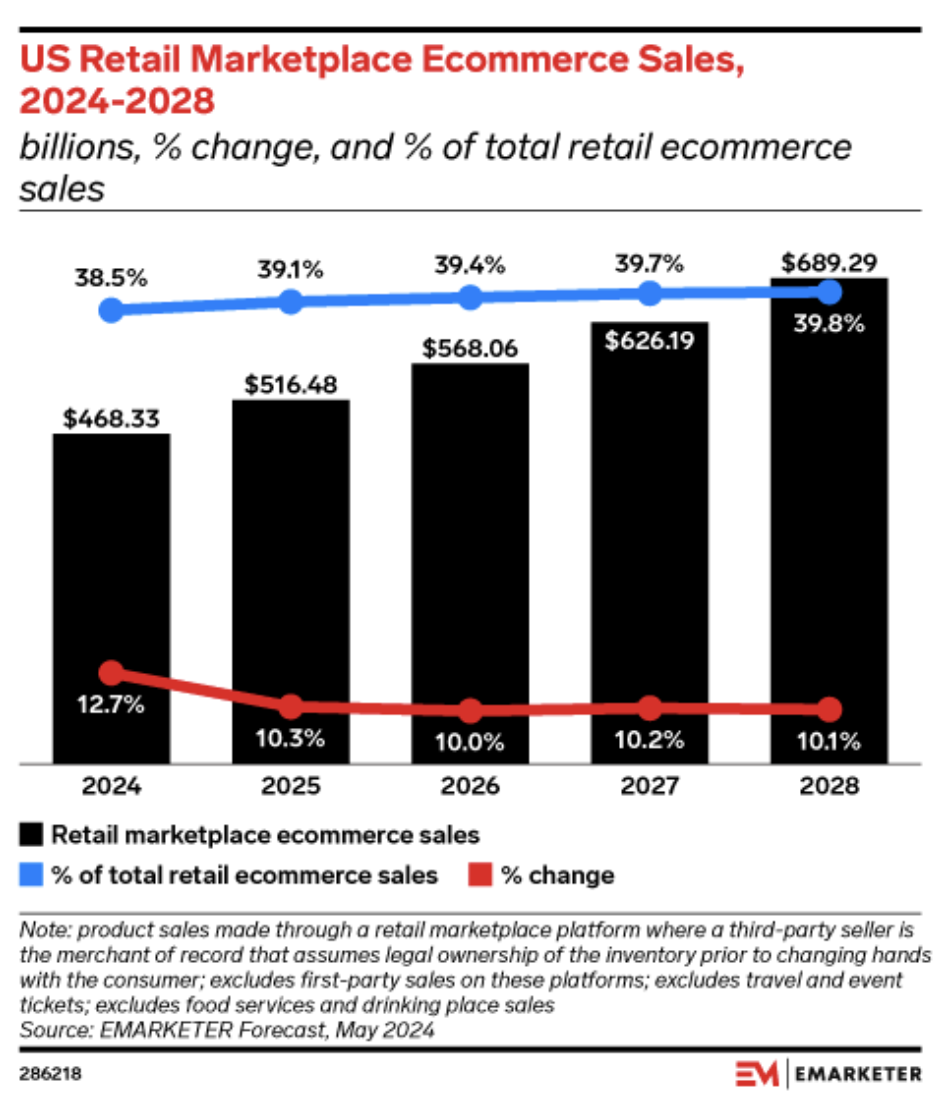

Marketplaces are the most dominant platforms for consumers and brands. Most markets are seeing marketplaces have dominance as it is able to showcase an infinite supply of products. These platforms have marketing and advertising tools that help brands find new audiences that are highly qualified and have intent. These platforms have invested in logistics that have surpassed postal services in ensuring purchased items are delivered to consumers. To summarize – they get the most eyeballs, have the best conversion rates for sellers and offer customers peace of mind with delivery. Just look below.

Source: EMARKETER

In Summary

Marketplaces are at risk when its algorithms are no longer sacred. In order to mitigate this risk platforms need to invest in complimentary businesses such as advertising, logistics, and programs that leverages their tools to assist non-marketplace sellers to grow their businesses. Buy with Prime was designed to mitigate the risk of potential regulation. Globally marketplaces are at different stages of mitigation.

If algorithms can no longer dictate economic impact – it requires marketplace platforms to mitigate risk through the use of their platform to drive effincies. We are at the beginning of regulatory arbitrage as businesses try and find opportunities in grey areas which regulators need to strengthen.

- CMA Investigation into Amazon’s Marketplace ↩︎

- Mexican antitrust commission: Amazon, Mercado Libre hinder effective competition ↩︎

- South Korean regulator asks Chinese e-commerce platforms’ for business data ↩︎

- European Commission requests information to Amazon under the Digital Services Act ↩︎

- Supervision of the designated very large online platforms and search engines under DSA ↩︎