I started researching Qoo10 six months ago as I had not heard of the company. A Singapore-based marketplace operator who acquired Wish for $173M. When I think of South Korea, I think about the market leader Coupang, who acquired Farfetch in a market that contains some of the most sophisticated consumers in the world. I believe only Chinese consumers are more sophisticated than those in South Korea.

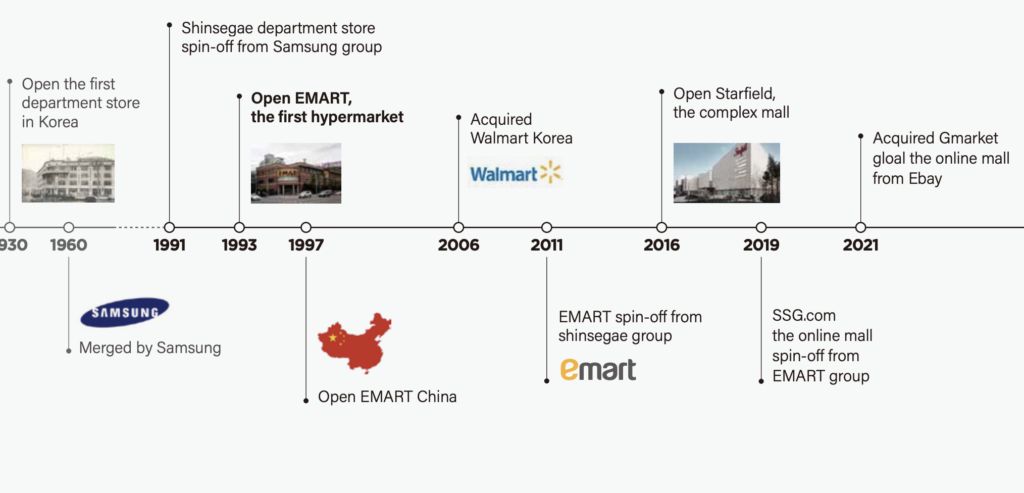

Years earlier, I heard about Gmarket, which eBay acquired in 2009 for $1.2B. Gmarket was one if not the most important assets eBay acquired to grow its international business. Gmarket was one of the companies I heard of behind closed doors. In 2021, eBay changed its global philosophy and started selling assets to exclusively focus on its most important assets. eBay sold a majority stake in its Korean business to Emart for $3.6B in 2021. eBay retained a 19.99% holding of its Korean companies, including G-Market, IAC, and G-9.

Source: Emart

I mention Gmarket and its demise from market leadership to being another competitor to Coupang as an example of how quickly a market changes due to mergers and acquisitions activity happening.

Understanding the South Korean E-commerce market

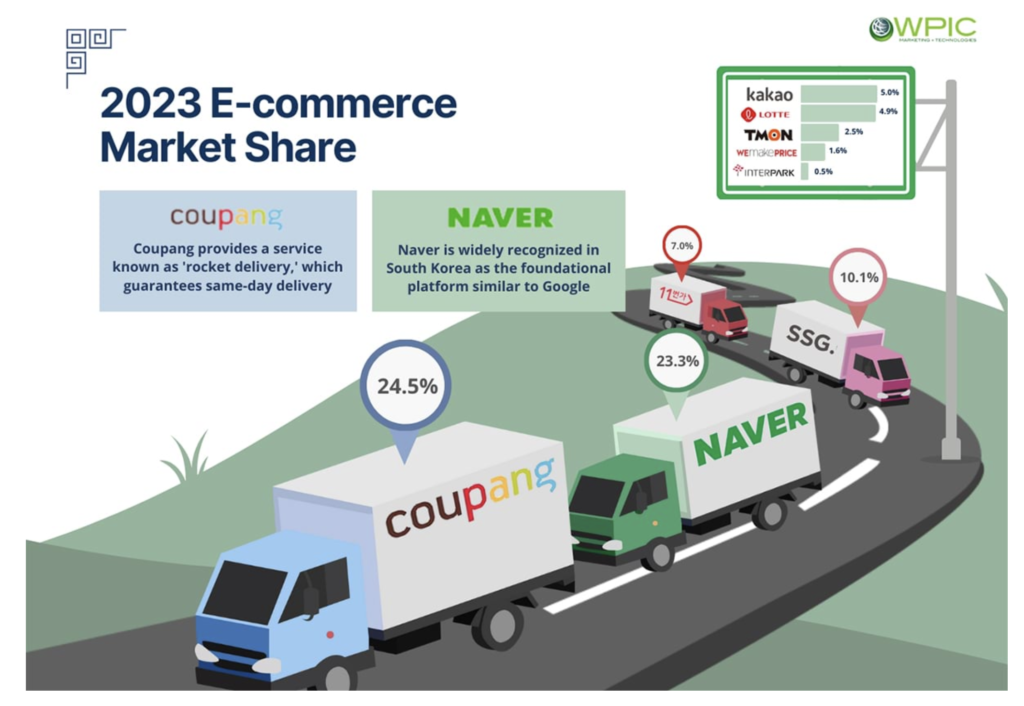

Source: WPIC

Understanding South Korean e-commerce is essential to understand the country’s size. South Korea has e-commerce warehouses closer to customers than any market. Coupang’s success, in my mind, is directly connected to its Rocket Delivery program, which offers same-day delivery of goods to consumers. Notice no mention of Qoo10 explicitly but rather assets such as TMON and WeMakePrice.

Qoo10’s beginning and acquisition history

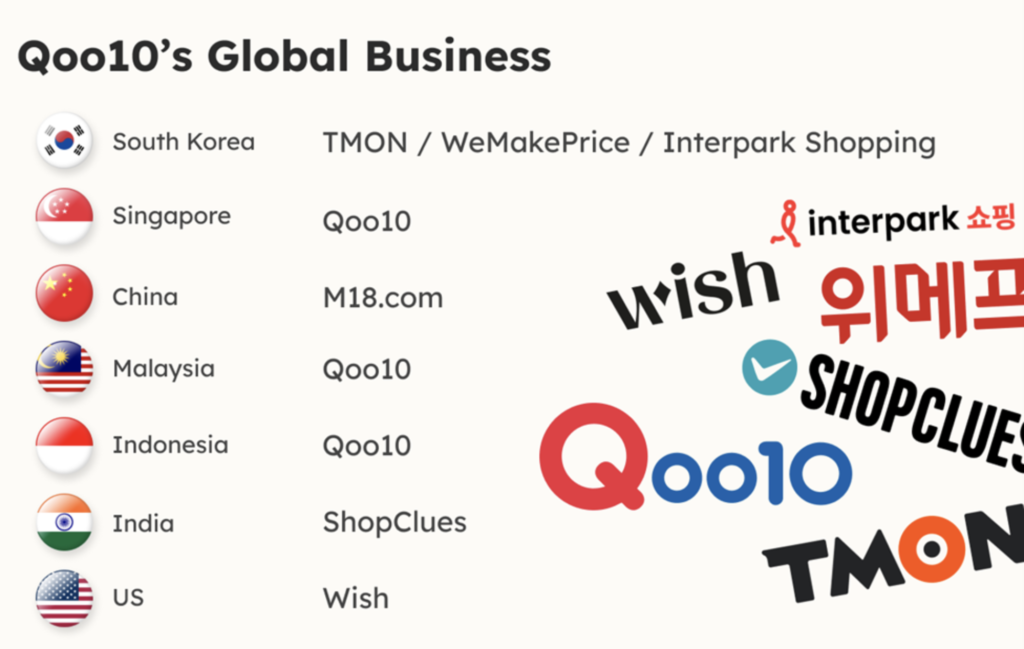

Gmarket founder Ku Young-bae started Qoo10 in 2010 and raised $102M from investors such as The Carlyle Group, Oak Investment Partners, Kohlberg Kravis Roberts (KKR), eBay, Bain Capital Ventures, Brookside Capital, Cuscaden Peak Investments, Nexus Venture Partners, and others.

Qoo10 acquired ShopClues in 2019, TMON in 2022, WeMakePrice, Interpark in 2023, AK Mall and Wish in 2024. The ShopClues acquisition was an all share transaction. The TMON transaction was a combination of stock and cash. TMON’s largest shareholders, Anchor Equity Partners and Kohlberg Kravis Roberts & Co., have agreed on the stock swap deal with Qoo10, according to the sources. Under the deal, the two shareholders will trade their 81.74 percent stake in TMON with new shares issued by Qoo10′s logistics affiliate, Qxpress. The remaining amount will be paid in cash. Qoo10 acquired the largest shareholder Wonder Holding’s entire stake of 86.2 percent in WeMakePrice, and the remaining shares owned by NXC, the holding company of local game developer Nexon. Qoo10 bought Interpark Commerce, an Interpark spinoff. The Singaporean entity declined to disclose the price and the ownership stake, although local media reports it bought the spinoff for 150 billion won ($115M). In March 2024 the company acquired acquire South Korean department store chain AK Plaza’s online shopping platform AK Mall for 510 million won ($377,778).

These transactions were for assets that were no longer leaders and, in some cases, in need of capital to scale. To purchase these assets the company had to convince private equity investors that its future is the best for these assets. The investors had to receive shares in Qoo10 or from its subsidaries as a means to pay for these companies. Its clear that the founder believed that he needed to aggregate assets to reach 10% market share in South Korea to be able to generate cash flow. This is a very complicated acquisition strategy that is dependent on growth and future success in order for it to work.

The Qoo10 business strategy was to bring international sellers to its South Korean assets (TMON, WeMakePrice, and Interpark.) The other part of this strategy was to offer cross-border opportunities (ShopClues) to South Korean sellers. Transactional volumes increased on all the South Korean platforms post-acquisition from Qoo10. The company’s logistics business, Qxpress, has been responsible for distribution and last-mile delivery for all of its platforms.

Source: The Korea Economic Daily Global Edition

Wish starts the beginning of the end

I did not realize it, but the day of the Wish acquisition news was the beginning of the end for Qoo10. Qoo10 acquired Wish from Contextlogic for $172M, which did not make headlines initially but the fact that Qoo10 had to take capital ($29M) from WeMakePrice and TMON to complete the Wish purchase. This reminded me of a private equity strategy called a leveraged buyout (LBO) in which debt is used to settle the acquisition.

WeMakePrice and TMON were unable to pay partners due to having liquidity challenges. That said the Qoo10 companies had unorthodox seller payment structures (60 day post transaction) in which merchants were paid months after transactions occured. The companies had been struggling to settle payment for transaction that occured in May 2024. To put it in context – TMON and WeMakePrice has a combined turnover of 1 trillion Korean Won ($722M) monthly and likely have to pay $70M monthly to pay sellers and travel operators that sell via its platforms.

Large retailers such as Lotte Shopping and Hyundai Department Stores stopped selling on these platforms once payment became an issue. It must be noted that consumers were initially able to receive refunds from travel booked through TMON. Travel companies have since stopped honoring tickets bought via these platforms.

The South Korean government stepped in to investigate Qoo10 and the lack of payment to sellers. Offices and homes were raided to confiscate data and documentation related to the liquidity challenges faced by the companies. The South Korean government has since estimated that missed payments by the e-commerce platforms had grown to around 210 billion won ($152M). Initially there was talks that WeMakePrice could be acquired by AliExpress or Temu but AliExpress indicated that it was not interested and that Temu had to engage with Pinduoduo.

Brands, sellers and small businesses impacted by the lack of liquidity from WeMakePrice and TMON are now able to access loans from the South Korean government who has made 560 billion won (US$445M) accessible to those affected, 200 billion won of funds from public institutions for small merchants, another 300 billion won of credit guarantee funds and an additional 60 billion won will be available for travel agencies hit particularly hard by the payment delays. WeMakePrice and TMON has since filed for receivership and are likely to be restructured. Private equity funds have taken control over Qxpress which the founder wanted to take public. Interpark has also filed for restructuring.

Lessons to be learnt from this disaster

We have yet to see any form of business aggregation to be successful and lead to sustainable revenues. Buying businesses who are number three to five in a market and adding complex acquisition finances with it – will not lead to success. Using shares to purchase enterprises to is akin to using financial gymnastics to ensure success.

Did the founder of Qoo10’s ambitions lead to bad decisions? This is a hard one to answer as one does not know how private equity investors impacted these transactions and the various assets it bought. Why was it necessary to acquire two horizontal marketplaces in South Korea? Why acquire the founder’s company (Interpark in the early 2000s)?

I do find it interesting that he wanted to take the logistics company Qxpress public in the US. So, let’s lose money on the marketplaces and then use it to power a logistics business. The logic is questionable at best.

As I said in Around the World in Commerce 303 – we have likely seen the end of Qoo10. The impact of nodes being unable to pay other parts of the business essentially leads to additional strain for that node.