Over the last few weeks, I have been thinking about the battle between Amazon and Temu in multiple e-commerce markets. Who is winning, and when will this end? This will not end like Wish, as Temu has access to much more capital than Wish ever had. The question should be, how does this battle between two horizontal marketplaces end?

In multiple markets, such as South Korea and China, consumer-to-manufacturer (C2M) marketplaces take market share away from dominant horizontal marketplaces. What is this all about? Which horizontal marketplace can offer Chinese factories/manufacturers access to consumers who want to purchase their goods?

The battle never once thought possible

A decade ago, it seemed impossible to conceive that any marketplace would battle Amazon in any market, let alone the US. Why? Amazon was the dominant horizontal marketplace with an infinite selection of what consumers wanted. Companies like Alibaba or JD.com were also not interested in entering the US due to Amazon’s ownership of search results and consumer sentiment. What changed?

The Chinese economy has slowed down and consumers are spending less online. Secondly, Chinese manufacturing has almost grinded to a halt which impacts factory owners who need manufacturing to be able to pay salaries. Due to regulations and a recession in China, Chinese marketplaces have gone overseas via cross-border e-commerce to generates revenues. In 2024 the Chinese government has made cross-border e-commerce a national priority.

Second order implications of Amazon vs Temu

What is driving Shein, Temu, TikTok Shop, and AliExpress’s adoption globally? Economic headwinds being faced by consumers globally are forcing them to purchase cheaper items or trading down. What we are learning is that consumers do not have an issue with waiting seven to nine days for a package from China.

These platforms have taken advantage of deminimis to not pay duties and taxes when goods are moving across borders. We have seen countries such as Brazil, Turkey, and South Africa increase the taxes of low priced goods from cross-border marketplaces. It is fairly likely that counties will close the deminimis loopholes to ensure that these platforms must pay taxes. This seems like a solution but it has unintended consequences such as Nike pausing cross-border online sales into Turkey. Have we thought about the impact this has on Global-e and ESW? I think not.

Brand equity is under deeper threat from these cross-border marketplaces. Amazon has always taken brand out of the discussion with customers. Cross-border marketplaces have shown us that private labels are under threat as manufacturers can now go directly to consumers without the need for retailers buying goods to be sold in their stores.

It all about perception. How do consumers feel about buying from Temu and others? We see brands talking about the importance of sustainability yet consumers are buying from Chinese manufacturers and have no real thought about the impact it might have on the environment.

Perception is going to play a big role in this battle

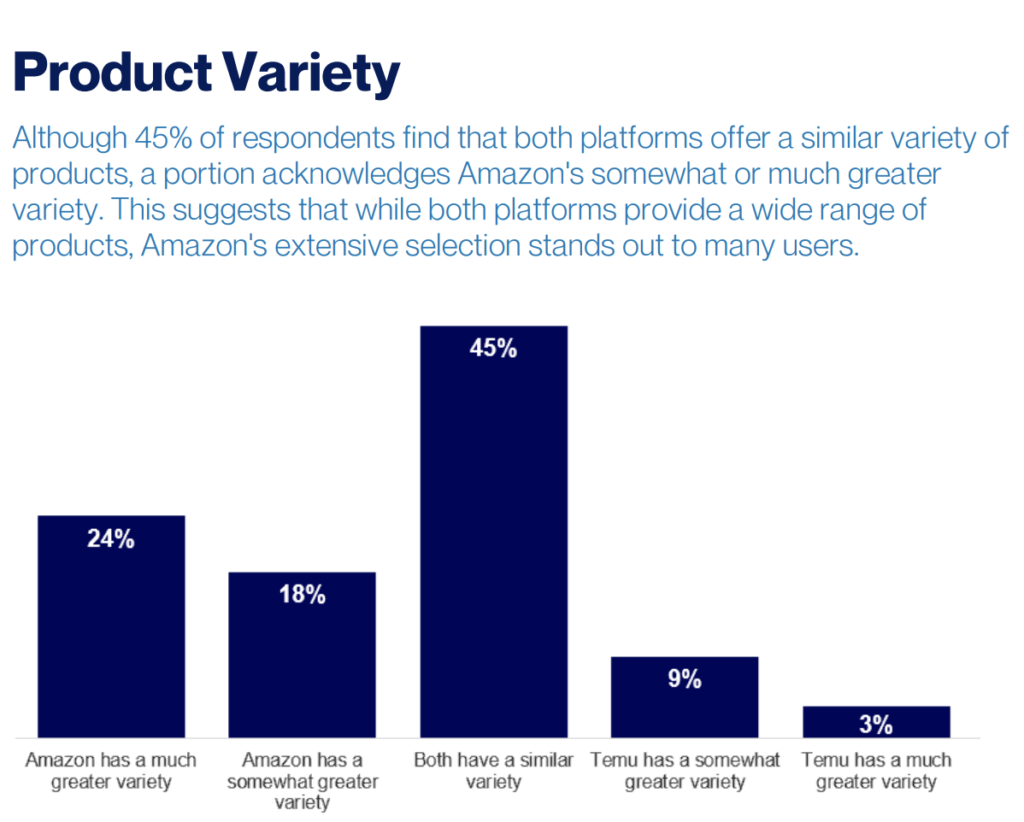

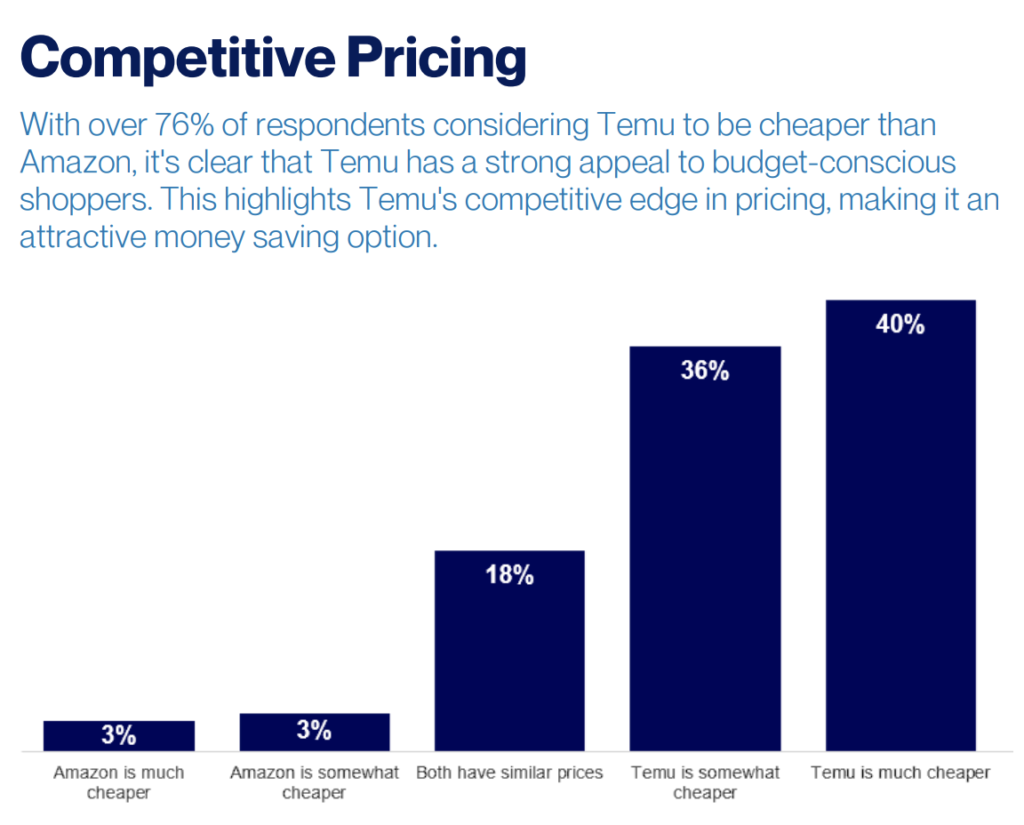

Probolsky Research did a survey with 340 US consumers on their feeling about Amazon and Temu. Here is some takeaways:

Amazon and Temu have similar selection of products.

Temu has cheaper pricing.

So who is winning?

Amazon is clearly trying to negate the impact of Chinese cross-border marketplaces by offering Chinese factories access to a discount section on Amazon. Amazon likely will also start shipping goods directly from China just like what Temu and other have been doing for a few years.

I believe that once Amazon starts doing direct fulfillment from China it could start charging no fees or discounted fees for using their warehousing in China that contains goods that are not spending long time in these warehouses. Temu is well capitalized and can go in a price-war with Amazon and drive pricing down for goods made in China. Temu has been feeling pressure from factories who have not been paid or been penalized for returns. As I said last week – someone is being squeezed to provide these low priced goods. Is this another case of sellers that will churn and be replaced by others similarly to how Amazon churns sellers?

Temu does have a big challenge in the last mile to US customers. Temu wants to pay at maximum $1 for the delivery of a small parcel. They could subsidize it by another $1 but this has no chance in scaling. The company is working with startups such as UniUni and others such as SpeedX or RoRo to have less costs for last-mile shipping. Chinese sellers like Temu more than Amazon’s China business.

Perception on who the Amazon and Temu customer is important. Are they the same customer or are Amazon customers using Temu to buy high-frequency used products that are cheaper on Temu?

It will take years for the US to implement changes to deminimis and it is likely that Europe will change theirs by 2028. Who wins? At the moment I need more data to make a decision.