The more things change, the more they stay the same. My LinkedIn feed contained posts about Amazon mass terminating vendor (1P) agreements. These businesses have been given sixty days to move their businesses to sell via Amazon’s third-party seller platform. Why are these terminations news, and what impact will the terminations have? While I am sympathetic to these brands that have been bad news in Q4 before Prime Big Deals Day and the festive season, it could have been much worse.

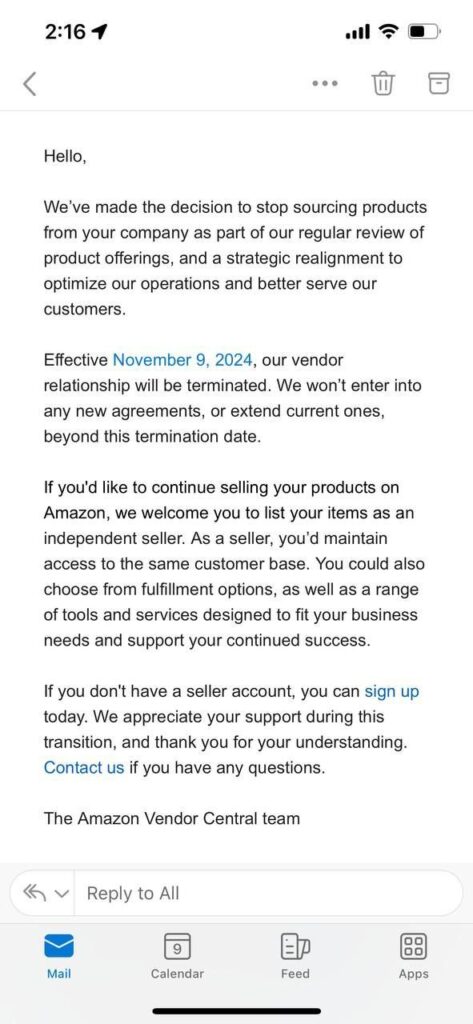

The viral screenshot of the Amazon Vendor Central email sent to select vendors.

Amazon vendors must be reminded that selling via 1P is seemingly a privilege, not a right. Amazon uses supply and demand and exclusivity better than any e-commerce platform. The business model has been replicated by venture capital and private equity with little or lower margin. The business model only works for Amazon due to contribution profit. Using different parts of the Amazon business, such as advertising and logistics, combined with volume, will generate margins that make sense.

Exclusivity enables Amazon to manage the wholesale relationship

Amazon wants inventory that moves quickly and enables them to have better margins. Wholesale enables retail to generate profits on goods bought. Amazon’s vendor program was created to generate profits and better margins. Exclusivity also allows Amazon to negotiate with these brands and provides an opportunity for others to aspire to. Consider the following: a decade ago, Amazon’s business depended on its vendor relationship and platform. Over the last five years, Amazon’s business model has shifted to being a platform for third-party sellers using its services, such as advertising and logistics, to enable an infinite shelf. Could Amazon sell its vendor business to a large private equity firm such as CVC or Silverlake? The vendor program also generates regulatory risk for the business as it competes with its sellers on product listings.

Did the vendor program lose its exclusivity? Potentially. Secondly, Amazon is likely aware that Temu is approaching some companies to sell on their platform. The merchants need to generate more than $2 million in annual sales for Temu to consider it. Why would Amazon continue to have a vendor business that can be disrupted by Temu? Removing certain vendor relationships ensures that vendors and brands are unlikely to leave them.

1P is not a business model for success

Amazon consultants (not all) have a tendency to tell brands that selling wholesale is a good business model. I have never heard such slander. Brands are selling to Amazon to have a purchase order that generates revenues. In most cases, this revenue is at a lower margin and still requires investment negotiated annually. Secondly, your pricing power is diminished as Amazon will price-match the item when sold at other retail locations or online. It also generates a dependency on Amazon that is full of risk as they can stop sending purchase orders anytime.

Selling your products through a hybrid strategy (a mixture of vendor (1P) and third-party (3P)) is the most profitable business model that helps brands maximize profits. 3P selling also enables brands to grow their multiples when discussing investments or exits. Yet, brands think that selling to wholesale Amazon is a good strategy.

Conclusion

Selling via Amazon requires skills and an understanding of the business model available to brands. Why have we not heard who these brands got this email from Amazon? Brands will not want to publicly admit that their operations failed them. We can speculate on these brands’ category and size, but the devil is in the details. Brands need to understand the risks involved with the 1P business model. Executives should not be blinded by the purchase order size but rather understand the risk this places on your business.

Amazon annually re-evaluates its entire business. They are clearly derisking their operations and are likely to open up space in warehousing when these brands no longer send pallets to warehouses. Amazon’s current flywheel is driven by its services businesses, such as advertising and logistics. Moving these vendors to third-party selling will increase the 3P business that they quarterly report and revenues generated from selling on Amazon.

Agencies must be mindful that brands must have a hybrid selling strategy to succeed. Profit and margins are generated via third-party selling, while vendor selling generates stable revenues that require planning and strategy. I have yet to witness agencies understand the complex relationship between 1P and 3P selling on Amazon. Relying on a single Amazon strategy has its risks and business impact. I believe it’s safe to assume that Amazon sales are a large (between 40 to 50 percent) of total revenues in many cases. Agencies must do due diligence on how to maximize third-party selling on Amazon, whether through authorized reselling or the brand managing the sale of its goods on Amazon.

Private equity funds must understand that selling on Amazon differs from selling to retail and requires unique skills and expertise. Your brands should have precise analytics and metrics to ensure that you can understand margins and profits.

Final thought

Amazon is like a movie that you have seen multiple times. The same things happen at different times for brands and sellers to understand. We likely have not seen the last of them closing vendor agreements. It is the management of the brand’s best interest to understand the risk and reward related to this news and how it might impact them.