Over the last two weeks, I have been seeing signals that make me concerned about the next twelve months. As someone who has looked at patterns for a large part of my career, these signals individually can be seen as news, but combined, they highlight a challenging year ahead. What happens in Q4 and in 2025?

What am I seeing? I am seeing customer spending patterns change worldwide and large incumbents laying off staff. These incumbents are large-cap companies that rarely do layoffs, which tells me companies see a problematic financial time ahead. Yes, in most cases, these companies overhired but laying off 1000 or more people is about cost savings or shuttering businesses. Is this an early sign of the artificial intelligence impacting employment? I think not.

Source: Cheezburger

What Are The Signals That Lead Me To Wonder About Q4?

Why are financial institutions like BlackRock accelerating the need for acquisitions or getting out of assets as seen inside the Amazon aggregator sector? Servicing multiple companies in the same sector is not efficient nor makes business sense. BlackRock has been derisking their business throughout 2024.

In South Africa, Takealot, a horizontal marketplace sold their fashion and apparel business Superbalist after owning it for over ten years. Media reports indicate that the marketplace wants to focus on its marketplace business and its delivery operations (Mr D). If the asset is a loss maker, why sell it to a private equity consortium? Recoup the cost if possible and sell the asset to have less expenditure in the next 12 months. De-risking for the future.

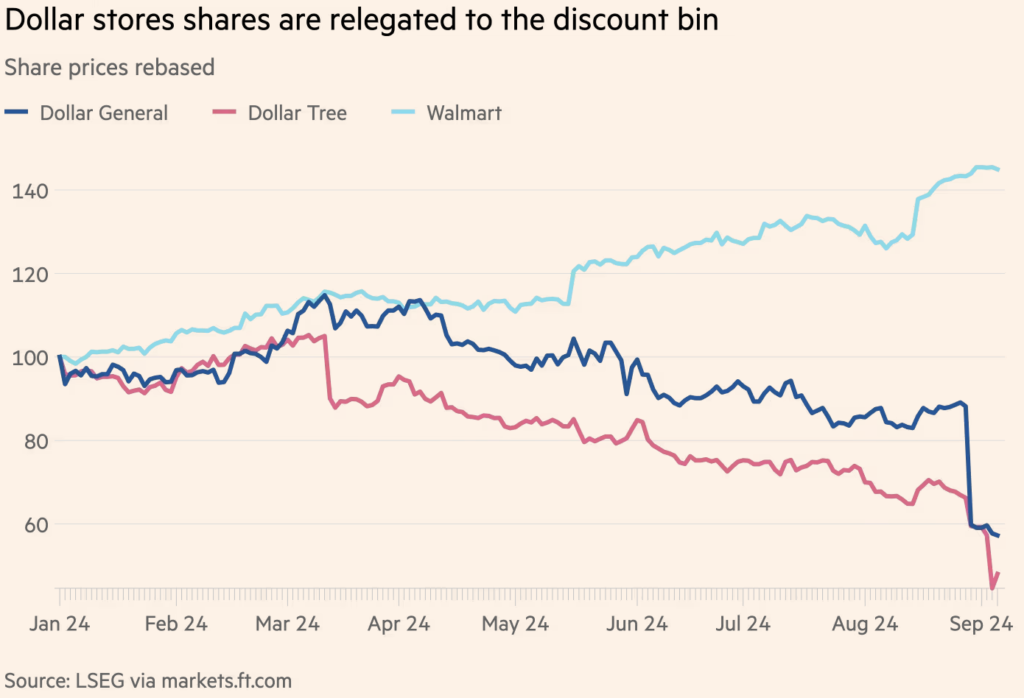

Thirdly, we are seeing globally the impact of Temu as consumers trying to downsize their monthly budgets due to a cost of living increase. Temu has seen the benefit of their parent company, Pinduoduo (PDD) having a lower share price and being in a distressed economy. PDD will invest in advertising as customers globally look to buy cheaper products. Who is impacted by this? Dollar stores, department stores, and apparel businesses.

Source: The Financial Times

Horizontal Marketplaces Struggles While Retailers Grow

It is not interesting that Amazon missed revenue expectations, and Alibaba experienced a negative two percent decrease in its Taobao and Tmall Group. Compare that to Walmart and Shoprite Checkers, which have seen significant growth amid customers becoming value-orientated. Is it easier for retailers to add e-commerce to their operations than an online marketplace to add retail to their business? Consumers are telling me adding e-commerce to a retailer is more convenient and effective versus an Alibaba or Amazon adding retail operations to their brand.

I believe we are also seeing a rationalization of customers between online platforms and retail. I must confess that I have always thought that marketplaces provide solutions to the top end of the market, and retail solutions are mostly demographic-specific. Big box retailers like Walmart have a customer profile ranging from lower to top of the market. Amazon Prime is the most critical part of Amazon’s business as it provides more than $10B quarterly. My point is that these customers initially were only Amazon customers, but as the years are moving along, these customers are also becoming Walmart customers.

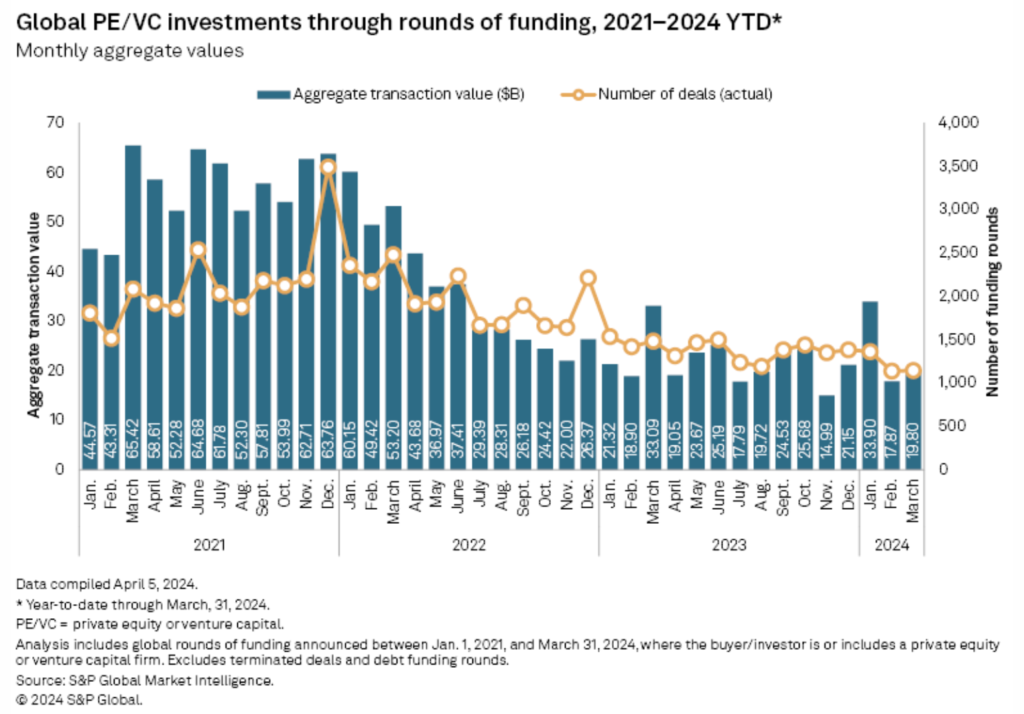

Funding climate in 2024

As we progress through the year, venture capital investment into the consumer sector is dead.

Source: S&P Global

What I see is that private equity investors are investing in consumer brands. In some cases, these are distressed or underperforming assets that must go private. I believe that in 2024, we will continue to see this trend. Late-stage venture capital-funded companies will look into alternative financial funding (hello, debt investment, my old friend).

So what does this mean for me?

I have been preaching about making good decisions daily to ensure that e-commerce companies do not put themselves potentially at risk. Secondly, unprofitable businesses should be stopped immediately, and only profit-making activities should be prioritized. I am also seeing that four to five year old startups that do not have product-market fit are under pressure from their investors. Expectations need to be managed, and Q4 performance should be expected to be flat or mildly profitable.

E-commerce executives need to be nimble in the next six months. Less is more – why does it require you to list all your SKUs on all hundred platforms. Prioritize the revenue and profitable platforms. In my experience in 2024, most consumer companies do not understand that Amazon is a crucial driver to their immediate future. I expect Amazon to re-evaluate its first-party business and stop certain 1P partnerships. Those brands need to carefully plan their seller experience on Amazon. 3P places different demands on brands and companies.

Agencies must understand that opportunities will happen on platforms requiring quick decision-making. Have you evaluated your client’s strategy on a particular platform? How will this platform reward investment during the critical parts of the e-commerce calendar (shopping holidays and the festive season.) Managing the complex relationship between inventory and advertising will be critical in the next six months. Why? Expect advertising costs to increase as the platforms take advantage of shoppers shopping earlier. Take part in programs that help your brand partners generate profitable revenue. Understanding that advertising and higher logistics costs will impact contribution and margins.

Private equity investors will likely see more deals and potential transactions than in previous years. Why? Brands will close in Q4 due to incorrect strategy or destructive operations and planning. Secondly, assets require deep analysis to understand why they failed. Buying distressed assets has an upside-only if the reasons for closure are understood. I have yet to see brands with an easy turnaround but, in most cases, have deep-seated risks or issues that require capital to resolve. Private equity will also see late-stage venture-backed companies looking for debt investment as new venture funding is not being found.

I believe that signals are happening around us and sometimes go unnoticed, which can harm online businesses. I remain convinced that e-commerce is hard and requires making good decisions in all departments to ensure survival.