Let me start off by saying that I am not an accountant nor a financial professional but I believe that there is a story that has been developing that can impede Amazon’s dominance in the US. Amazon is a hybrid marketplace in the US as it is both a retailer and allows third parties to sell to their customers to ensure that they can be the “Everything Store” that has virtual shopping isles that has an infinite length. Amazon has inadvertently created a situation in which sellers are generating sales to States without them knowing the location of their products due to them using Fulfillment by Amazon (FBA). As Amazon moves products to warehouses all over continental US these sellers are generating Tax Nexus in States that could lead to an increase in tax to certain States.

Amazon has been seen by many and a certain leader as not paying tax and thus negatively impact retailers in the US. Amazon has started collecting taxes in most states to ensure that they can build logistics facilities closer to customers in various US States.

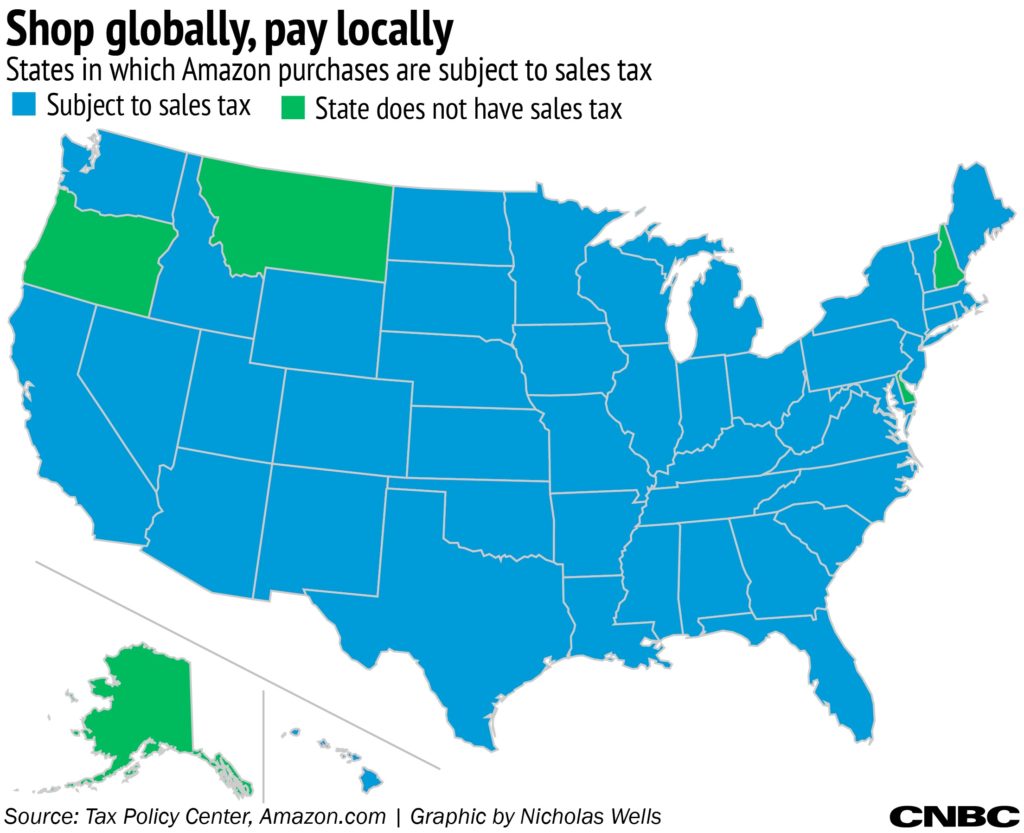

According to CNBC, after 1 April, the only states in which Amazon won’t collect taxes are Alaska, Delaware, Oregon, Montana and New Hampshire. These five states don’t have sales levies.

Amazon has over the years made it clear that they are not responsible for the products that are sold on their marketplace nor are they required to enforce the collection of sales tax by third party sellers.

The Reality for Nexus Tax Collection

When Amazon started the third party selling the primary reason was for content generation and to ensure that they could ensure that they have the products that customers are looking for. However, as third party sellers are now 51% of Amazon total sales the impact of this Tax Nexus situation could be drastic.

Imagine if Amazon is to lose the top 5% of their third party sellers based on monies owned to US States. Suddenly Jet.com and Walmart get a boost in which customers will flock to them. The interesting thing is that it seems that Amazon is willing to help collect taxes in Europe.

The service covers VAT reporting obligations in France, Germany, Italy, Poland, Spain, Czech Republic and the UK. Integrated within Amazon’s Seller Central, VAT Services on Amazon supports Marketplace sellers with local VAT registration, reporting sales from Amazon Marketplace and other sales channels if necessary, as well approval and filing of relevant VAT documentation.

The European tax collection is done via a third party that Amazon has partnered with according to Amazon insiders. So it seems that Amazon is doing one thing in the US and something completely different in the US.

When Amazon moves seller products to fulfillment centers they ensuring that sellers are selling products in States in which they can meet the Tax Nexus without ever being aware of that fact.

2017 Amazon FBA Sales Tax Amnesty

When I was in the US in October last year I had multiple conversations with folks in Seattle regarding this very important matter. Amazon has been unwilling to publicize this Amnesty program that was initiated by the organizers of the PROSPER Show who spoke with the relevant parties to ensure that Amazon sellers are not harmed with historical back taxes.

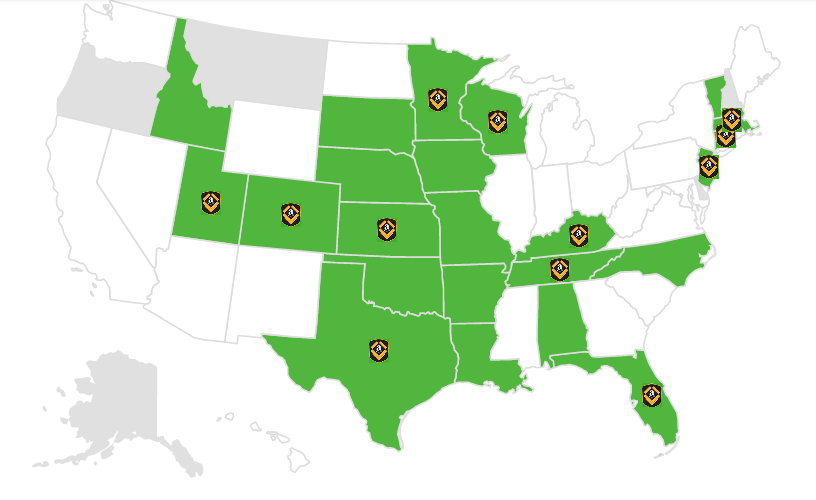

Image Source: TaxJar

Sellers have the opportunity to gain amnesty from historical back taxes by registering for this amnesty program. I suspect that after 17 October 2017 States are going to start looking at online sales tax collection in a much harder way. There is not one State that I am aware of that are not in need of capital from sales made inside their jurisdiction.

The hard work that the PROSPER team has done has lead to this monumental moment. Here is the Press Release regarding the 2017 MTC Sales Tax Amnesty Program.

At our March 2017 PROSPER Show, we welcomed speaker Richard Cram, the Director of the National Nexus Program for the Multi-State Tax Commission, a national organization that coordinates sales tax teams across multiple states. Richard spoke about the sales tax implications of being an FBA seller, having one’s products distributed by Amazon across potentially dozens of states. The placement of product in these states most likely creates a responsibility for FBA sellers to collect and remit sales taxes for product sales in those states.

The Multistate Tax Commission National Nexus Program is offering a special limited-time voluntary disclosure initiative (described below), in which the following states are participating:

- Alabama

- Arkansas

- Colorado [1]

- Connecticut*

- District of Columbia[2]

- Florida*

- Idaho

- Iowa

- Kansas*

- Kentucky*

- Louisiana

- Massachusetts [3]

- Minnesota [4]

- Missouri

- Nebraska [5]

- North Carolina

- New Jersey*

- Oklahoma

- South Dakota [6]

- Tennessee*

- Texas*

- Utah

- Vermont

- Wisconsin* [7]

Current states containing Amazon fulfillment warehouses, as of August 14, 2017*

The States listed above will consider applications for voluntary disclosure received by Multistate Tax Commission (MTC) staff during the time period August 17, 2017 through October 17, 2017 from taxpayers meeting the following eligibility criteria:

1. The taxpayer has not yet registered with the state taxing authority, filed returns with such state for the tax type that the taxpayer is seeking voluntary disclosure relief for (sales/use tax, income/franchise tax, or both), made payments of such taxes to, or had any other prior contact with the state concerning liability or potential liability for such tax type.

2. The taxpayer is an online marketplace seller using a marketplace provider/facilitator (such as the Amazon FBA program or similar platform or program) to facilitate retail sales into the state and has no location, property, employees, or agents in the state, except for the online marketplace seller’s inventory stored in a third-party warehouse or fulfillment center located in the state or other nexus-creating activities of the marketplace provider/facilitator on behalf of the online marketplace seller in the state. A “marketplace provider/facilitator” is a person who facilitates a retail sale by an online marketplace seller by (1) listing or advertising for sale by the online marketplace seller on a website, tangible personal property, services, or digital goods that are subject to sales/use tax; (2) either directly or indirectly through agreements or arrangements with third parties collecting payment from the customer and transmitting that payment to the online marketplace seller; and provides fulfillment services to the online marketplace seller.

3. The taxpayer has timely applied electronically (using either the online application provided on the MTC website at www.mtc.gov or MTC pdf application form available on the MTC website and emailed to MTC staff at email address nexus@mtc.gov) to the state for voluntary disclosure relief through the MTC Multistate Voluntary Disclosure Program (MVDP), in accordance with the process set forth at http://www.mtc.gov/Nexus-Program/Online-Marketplace-Seller-Initiative. The taxpayer will need to state in the application that the taxpayer is applying for voluntary disclosure relief under this initiative and provide complete and accurate disclosure of the information requested, which will be used to establish eligibility.

Note: The application form requests that the applicant provide an estimate of back tax liability to the state for the prior 4 years and contains the statement: “National Nexus Program staff will not process an application when the good-faith estimate for all tax-types for the look-back period is less than $500 in this state.” Please be advised that applications received under this special time-limited online marketplace seller voluntary disclosure initiative will be processed, even when estimated back tax liability is less than $500. Also, response times permitted in this initiative may be shorter than those provided in the MTC Procedures for Voluntary Disclosure, in order to ensure that the taxpayer timely complies with Paragraph 4 below.

4. The taxpayer is seeking relief from any past due sales/use tax, including interest and penalties, and if applicable, income/franchise tax liability, including interest and penalties, in connection with its online retail sales activity in the state, except for sales/use tax collected but not remitted, with the taxpayer agreeing to register as a seller or retailer with the state and timely collect, report and remit sales/use tax and file returns on all taxable retail sales to customers in the state prospectively as of the effective date (not later than December 1, 2017—taxpayers are encouraged to commence collection and remittance of sales/use tax prior to that date) of the voluntary disclosure agreement. If subject to income/franchise tax, the taxpayer further agrees to timely file income/franchise returns and pay such taxes due, commencing with the tax year including the effective date (not later than December 1, 2017) of the voluntary disclosure agreement. If the taxpayer has any collected but unremitted sales/use tax, then the taxpayer agrees to remit such tax to the state, including penalties and interest.

As provided in the MTC Procedures of Multistate Voluntary Disclosure, a taxpayer can apply to a state for voluntary disclosure anonymously and will not be required to disclose its identity to the state until the taxpayer registers with the state and the voluntary disclosure agreement is executed. The taxpayer may choose which state and which tax type (sales/use tax, income/franchise tax or both) to seek voluntary disclosure relief for. The taxpayer can also withdraw the application for voluntary disclosure with any state at any time prior to execution of the voluntary disclosure agreement.

Normally, when a taxpayer applies for voluntary disclosure relief with states through the MTC MVDP, the taxpayer will be required to file returns and pay back tax liability, plus interest, for the lookback period that the state uses, which is generally the prior three to four years or more, depending on the state’s law or policy. The state will then waive tax liability, interest and penalties for the time period prior to the lookback period. Under the special time-limited initiative described above, for taxpayers meeting the above criteria, the states identified above (unless otherwise indicated) will agree to waive sales/use and income/franchise back tax liability, including penalties and interest, for prior tax periods, without regard to any lookback period, provided the taxpayer registers as a seller or retailer to collect, report and remit sales/use tax and commences to file sales/use tax returns and remit sales/use tax as of the effective date (not later than December 1, 2017) set forth in the voluntary disclosure agreement, and if the taxpayer is subject to income/franchise tax, the taxpayer commences filing income/franchise tax returns and paying tax due, commencing with the tax year that includes the effective date of the voluntary disclosure agreement (not later than December 1, 2017).

Note: See footnotes for Wisconsin and Colorado. Wisconsin will require payment of back tax liability and interest for the following lookback periods: for sale/use tax, commencing January 1, 2015; for income/franchise tax, including tax years 2015 and 2016. The lookback period will be limited to prior years during which the marketplace seller had nexus. Colorado will provide back tax liability relief for sales/use tax, but will require payment of back tax liability and interest for a 4-year lookback period for income/franchise tax.

[1] Colorado will waive any back tax liability for uncollected sales/use tax. However, Colorado will not waive back tax liability for income tax beyond its normal four-year lookback period. Colorado notes that it already has a small seller income tax nexus exception for sales less than $500,000 into the state.

[2] D.C.’s standard lookback period is 3 years for sales/use and income/franchise tax. D.C. will consider granting shorter or no lookback period for applications received under this initiative.

[3] Massachusetts requires compliance with its standard 3-year lookback period; this lookback period in a particular case may be less than 3 years, depending on when vendor nexus was created

[4] Minnesota’s customary lookback period is 3 years for sales/use tax and 4 years (3 look-back years and 1 current year) for income/franchise tax. Minnesota will grant shorter lookback periods to the time when the marketplace seller created nexus.

[5] Nebraska will consider waiving back tax liability for uncollected sales/use tax and income tax.

[6] South Dakota imposes sales/use tax but does not impose income tax.

[7] Wisconsin will require payment of back tax and interest for a lookback period commencing January 1, 2015 for sales/use tax, and including the prior tax years of 2015 and 2016 for income/franchise tax.

The States participating in this special time-limited voluntary disclosure initiative have agreed not to disclose to other taxing jurisdictions the identity of any taxpayer entering into a voluntary disclosure agreement under this special time-limited initiative, except as required by law, pursuant to a court order, or in response to an inter-government exchange of information agreement in which the requesting entity provides the taxpayer’s name and taxpayer identification number. Blanket requests from other jurisdictions for the identity of such taxpayers will not be honored.

If you ask Amazon to collect sales tax for you, Amazon will do so and charge you a fee of 2.9% of the sales tax collected. To initiate this, go to Seller Central, Settings, Tax Settings, fill out the tax details by state where you want Amazon to collect taxes for you. Please remember that REMITTING sales taxes is exclusively the responsibility of the seller, not Amazon’s responsibility.

In Conclusion

I am generally Pro-Amazon in how they operate but this FBA and Tax Nexus situation should have been managed better. Amazon should be publicizing this to sellers much more as the implications on their marketplace business could be massive. As much as Amazon does not want to be seen as being involved with this, for their own taxation; this hands off approach will only fuel seller distrust.