As 2020 moves forward, I have been thinking about the unintended consequences related to the COVID19 virus. How it will change our lives is currently unclear. The illness has impacted every sector and activity, and unintended consequences are becoming visible globally. The law of unintended consequences is seen as a building block of economics, but it feels relevant to the current situation seen in the world.

The law of unintended consequences via the impact of regulation and legislation

Governments have done the right thing to protect citizens, but inadvertently forever changed retail, e-commerce, and commerce.

Retail as we knew it would not re-emerge as landlords, lack of footfall and consumer behavior shifts will ensure radical changes. Traditionally stores and malls acted as points of interaction, but it will become fulfillment locations instead of sources of inspiration. We have seen in China and Germany; consumers are not interested in going to retail locations based on concerns over a possible infection. They are cautious economically and are shopping online more.

Local and logistics – the outliers that have come in to focus

Logistics providers and postal services are either at breaking point or unable to service unprecedented demand. Those who stay outside of densely populated cities have had less selection and have required more time to find items as SMEs simply don’t sell to this customer set. Solving for areas that are not densely populated is a massive opportunity in all markets, and COVID19 has accelerated the need for more logistics operations. I can’t get Alibaba’s Hema business model out of my head, stores that deliver in densely populated areas to consumers in a 5km radius. That, for me, is the new normal for retailers looking to survive.

My thesis around local commerce has also significantly changed as finding local online retailers($) is next to impossible on Google, which rewards historical consumer behavior over new demand. While it looks to reboot its shopping service opportunistically, the truth is its core service is becoming less useful. Anecdotally Instagram’s remarketing and account discovery algorithms have held better results for finding local service providers. I now understand why super apps are and will remain the focus for platforms looking to win. If I could purchase groceries and basics on Instagram directly, then marketplaces are at a significant disadvantage.

COVID19 has also restarted the need for services to market products on a more location-based data set as not all cities allow purchase for specific items, categories, etc. While mass marketing has been mostly stable, the post COVID19 will require more profound and better targeting. I find NBCU’s acceleration of its OTT purchasing cart interesting. This fascinating development can potentially change traditional media to becoming more commerce-enabled in the long run and less dependent on advertising. I think of it as a mass media affiliate product that can help brands better reach consumers without the need for online affiliate products, which sometimes are leveraging vile, cringe-worthy parts of the Internet.

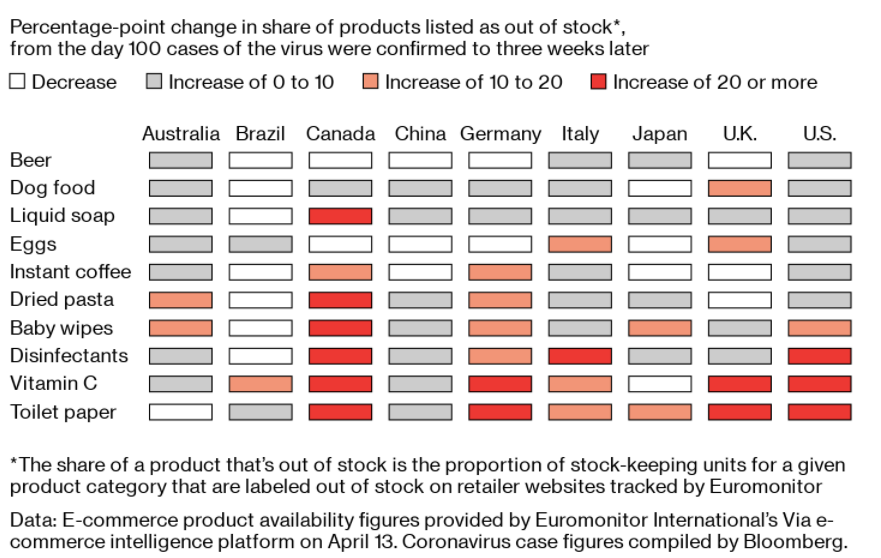

Maslow’s hierarchy focuses on foods

Our needs have changed, and specific categories are in deep trouble regarding wallet share. Globally essential items have excluded technology, apparel, and luxury, in which clothing seems to be in the greatest peril. We have learned over the lockdown that we have plenty of clothing in our drawers and cupboards, and the need for food and other consumables outweigh the obligation to purchase more clothing. While we need garments, the virus has placed certain products and categories in our minds due to Maslow’s hierarchy of needs. The apparel sector, for me, remains a concern as this has other impacts such as manufacturing in emerging economies that are without work. Pennies on the dollar acquisitions will occur, and others will go bankrupt sadly.

Our relationship with food has also changed. The purchasing of fresh fruit and vegetables, FMCG items will never be the same. Brands that only operate via wholesale to retailers have experienced significant revenue impact in comparison to brands selling direct to consumers. Cold chain logistics is going to become a bigger deal in the medium term as emerging markets have more consumers looking for fresh produce, dairy, meat, and fish products. How these items get to consumers will change post COVID19, and I suspect B2B e-commerce will become B2B2C for those that retail foodstuff.

The economics that needs to be reconsidered

Pre-COVID19 the mentality was that startups and marketplaces grew at all costs without thinking about the future as we were in a bull market. That is also gone, and e-commerce companies will have to be profitable faster to survive and potentially IPO. This market correction also is rebalancing private valuations that were frothy

The economic consequence of COVID19 also will impact M & A (mergers and acquisitions). Case in point, the U.K. is approving the investment made by Amazon in Deliveroo based on the fact that Deliveroo is an essential services provider in the U.K. Savy investors (there are a few) have either already moved the required assets into new ownership or doubled down on it as the pool of potential acquirers becoming smaller based on regulation.

Some risk is riskier than others

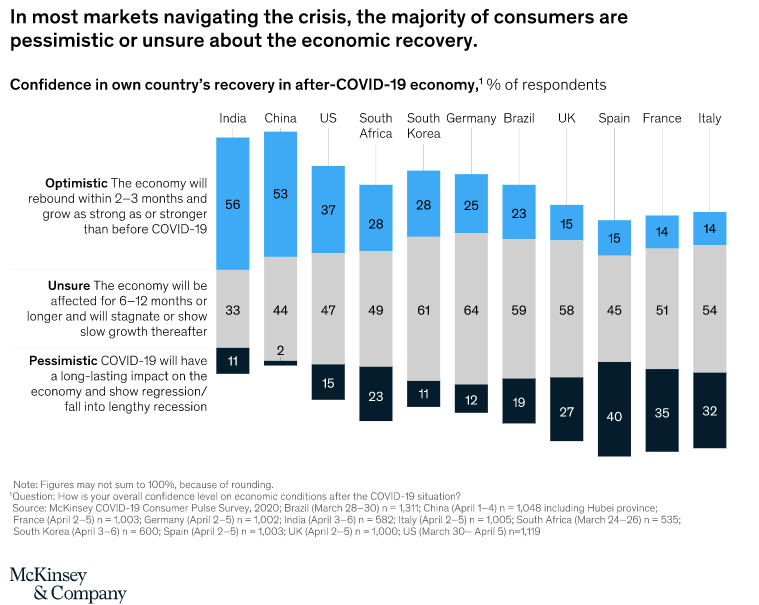

As China was the first nation to battle COVID19, it has become an analog for analysts, investors, and executives looking for future guidance. In times like these, political innuendo and perceptions have the opportunity to exaggerate fragile relationships. I read with shock this week, the SEC Chairman Jay Clayton cautioning investment into emerging market businesses (read China) due to risk.

This statement, for me, raises concern as it also has unintended consequences: If investors sell their investments or cut them to a rate and look for safer local investors, what would be the point for emerging markets startups to be listed on U.S. markets? Secondly, while there has been recent news on fraudulent activities by listed Chinese companies such as Luckin Coffee, not all Chinese companies act in that matter. Companies such as Alibaba, JD.com have had to jump through more hoops in comparison to their U.S. counterparts. I find this as a global citizen to be very disconcerting and behavior that will lead to economic harm for all involved. All financial investments have risks attached to them; the lack of consistent data being reported or audited is not just limited to emerging markets.