Over the past 18 months, the reality surrounding local e-commerce has become clear for me. The truth is the terms mean many things for many people, and it is an unsolved opportunity. COVID-19 is an accelerant for the commerce fire or misfires made by businesses of all sizes. Local commerce is helping consumers find products around them.

I have changed my mind and thoughts on this topic many many times. Yet it took to this past week for it to finally make sense. Let’s look at this topic in more detail and look at how the solution seems. As of 2020, I am no longer talking about e-commerce and retail as separate themes as we have moved past that. I refer to commerce as that is how we buy, whether in-store, online, or on-demand.

Commerce Hierarchy

I was on a podcast this past week as a guest and realized in the days after it; I may have ruined my thinking. To be clear, this is how commerce looks at a macro level.

- Cross-border commerce: Consumers can buy products online from stores headquartered in another country. They pay in their local currency and may or may not have to pay more due to duties. Currently, brands drive’s this sector in the US and Europe selling via solutions such as eShopworld, Flow, and others. I view that as cross-border version 1.0. Mamenta uses a different model to solve this opportunity to help brands access in markets such as Japan, South East Asia, and Latin America. They are leveraging marketplaces to reach consumers in emerging markets I view as cross-border version 2.0. There is also the use of distributors and wholesale businesses to move products into local stores etc.

- Global commerce: Consumers can buy from international businesses that have local operations. This is not the same as cross-border as consumers have more convenience and pay in their local currency. Brands also leverage this to enable consumers to buy from them as they have a local website that uses local fulfillment. Adidas, Nike, and Decathlon offer selection like that of their home market to local consumers.

- Regional commerce: Consumers can buy from marketplaces or businesses that are only available in a specific country or continent. Flipkart, Jumia, Lazada, MercadoLibre, Shopee, and Takealot, are only available to select consumers in specific geographic locations. Brands also follow this business model to ensure that they meet the demands of a particular country or region. The European Union has changed this to ensure that consumers from any European country pay the same as another European country’s consumers would. Superapps such as Alipay, GoJek, Grab, Mercado Pago, Rappi, Taobao, WeChat, and others are also part of this sector. The difference is that these businesses are low margin, high usage businesses that can compete and win against commerce businesses by being on the home screen of locals.

- Local commerce: This has had various names hyper-local, city-based, but I use local commerce to state that this sector is around the customer. Reliance’s JioMart is trying to solve this fascinatingly by enabling local corner stores the opportunity to use the Internet to sell to consumers. If you are a resident in populated cities such as Beijing, Cape Town, London, New York, Rio de Janeiro, Shanghai, San Francisco, it’s easy to purchase what you want. If you live 30km or 20 miles away from these cities, it is not as convenient, and that is where I am talking about today.

Local is in Zuckerberg’s hands – which is not good

Since the emergence of COVID-19, local commerce has returned to be in the news. Whether that is cities capping food delivery services and curfews, local is in the press and one of the last opportunities in commerce. To be clear, this is only in the West, as in China, Alibaba, JD.com, and Meituan have solved this in manners that make me smile. It works, and consumers can access whatever they want within reason, and it will arrive at their home. There are no surcharges for on-demand availability. These businesses have found creative solutions to serve cities and rural areas.

Prime members can have similar situations in the US and Europe, but there are few other examples of solutions to those seen in China. Amazon showed in March and April 2020 that it is very dependent on supply and demand curves that are historical. If a sudden demand spike occurs, its warehouses and supply chain is unable to be efficient.

What has surprised me is that Facebook’s Instagram and WhatsApp have become the drivers of growth. Local businesses use Facebook as a marketing channel to showcase social proof. They then link it with a private or business WhatsApp account, and transactions occur. Instagram offers local discovery better than what Google or even Facebook offers.

Local Commerce Challenges

- Local search seen on Google is nothing short of an abomination. It’s terrible, and the lack of relevant results should concern Sundar Pichai. Do not get me started on the Google Shopping tab and local – its useless. A local search engine, as seen with Instagram’s follower lists, has become a great way to discover local businesses.

- Some local companies have invested in Shopify stores but are then either self-fulfilling orders or at the mercy of logistics providers. Shopify still has work to do to make it easier for all small businesses.

- The amount of friction in selling artisan foodstuff or jewelry is large. A call, in some cases, is the best solution. In saying that, payment is also not part of Facebook’s stack for small businesses. Unless you are a DTC business filled with venture capital, Instagram’s shop and checkout are not available to all. So a wire transfer or electronic funds transmission (EFT) is still used as a payment solution.

- Long live the QR code. As cash is a potential agent for COVID-19, I have been using mobile payment wallets to pay for goods. Filling in credit card details is an inefficient process and contains risk. A mobile wallet is secure, and the payment via QR code works. The QR code usage is primarily still driven by apps such as Alipay, JD Pay, and WeChat Pay. Banks in the West need to realize that this is critical. Not every consumer has a Google or Apple Pay card or wallet.

- The much talked about conversational commerce has gone quiet. Investors who invested in companies such as TaskRabbit (acquired), Operator (acquired), JetBlack (shutdown), and others have gone silent. Was it a precursor to text-based commerce, as seen with Iris Nova? I am unsure as scaling conversation with NLP-based AI is still not accurate.

The Solution that would make Amazon and Google nervous

WhatsApp business account that offers links to QR code payment will solve a variety of current challenges. It ensures that business remains personable but enables communication and the opportunity to upsell consumers. Having experienced this a few times this week – this is the model in which WhatsApp generates revenue. Instagram should invest more in local commerce as that will speed-up its commerce ambitions.

When Lore met his match

Marc Lore is, according to many, the only executive who has been able to tame Amazon if you believe PR. In saying that, he has also made mistakes that are not cool to talk about nor mention.

Are you convinced it’s economical? I think it’ll be an economical service to offer. There’s a lot of excess delivery capacity in every city.

Bike messengers or delivery vehicles? Newspaper trucks.

Lore has aggressively pitched the company’s management and board on the idea that Walmart needs to spend billions a year on new warehouses

Bloomberg, Vox/Recode

I will never forget the laughter Donahoe created when he suggested that newspaper trucks could help eBay deliver. Well, who can remember that Marc Lore wanted to invest billions into warehouses to help Walmart out-Amazon Amazon? This moment is when Walmart re-emerged as Doug McMillon’s to lead as he used common sense. Using stores is the only way a large retailer will be able to offer Amazon-like convenience.

Stores are city-based warehouses if properly executed

Physical store locations should be fulfillment locations for local consumers. Most commerce businesses have real-estate that it needs to rethink for the post-COVID-19 world. For commerce businesses to be where consumers are (at home), they need to re-use investments made in stores, whether its curbside collection, on-demand delivery by gig workers any extra investment into warehouses make no sense.

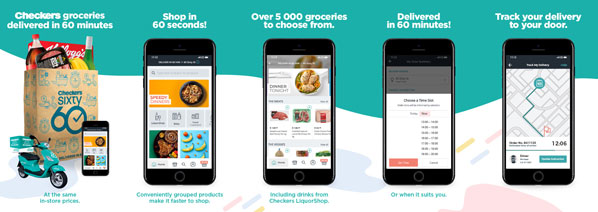

In South Africa, leading retailer Checkers (part of Shoprite Holdings) has launched an on-demand grocery service. Sixy60, 30 items in 60 minutes are the best commerce experience I have had in years. It reminds me of what I saw in China with Alibaba’s Freshippo, who can deliver within a 5-mile radius in 30 minutes. Local fulfillment that does not use Alibaba’s impressive Cainiao Network. JD’s 7Fresh does precisely the same.

Brands and Investors – Here are the facts on your next steps

Brands – have you thought about whether your products are available on these solutions? If your brand wholesales to retailers and does not have a DTC business such as Kraft Heinz, Oceanspray, and PepsiCo, well, you have a problem. A large one as consumers will not find or buy from you. The transactional nature of FMCG is price sensitive without any brand loyalty. I have seen this in my purchasing habits. Are you collecting feedback on the different channels used to generate sales?

Investors need to look at tools. These tools provide brands with solutions to take inventory currently in wholesale and distributors and make it available to the public. Tools that can add delivery addresses and generate cost-effective logistics costs to those who self-fulfill. Software that can connect or sit on top of Instagram and WhatsApp to automate payment, address details are in short supply. A local search engine based on commerce data remains an outlier and an opportunity.

Local commerce requires local solutions and not the use of logistics and supply chain assets. In conclusion, the consumer relationship with brands, offline and online commerce has changed. The world pre-COVID-19 will not return, and the opportunities to engage with consumers in high-touch categories are still lacking.